We file your accounting reports painlessly

Fever-free accounting services: we put together paperwork, check numbers, and file annual returns on time. Our Accountants answer fast and help optimise tax.

Preparing financial statements yourself is a pain in the neck

Filling out the reports is a lot of manual work

There’s no way to check if you’ve done it right

The filing deadlines always come at a bad time

Your time would be much more valuable spent on something else

Don’t take our word for it, try yourself. It’s free

You can test-drive MBS straight away: upload docs effortlessly, ask us anything in a chat, explore dashboard with daily cashflow, and much more. See what exactly you’re getting before you decide.

Save up to €1,080 on Accounting with Start Digital

1 year of Starter Accounting, Xero subscription, and Talenox or Shopify suite for only €600

Accounting plans that match the size of your business

Mini

€85/mo

€399/year

👉 DAILY SUPPORT

Personal Accountant & Bookkeeper

MBS software

Annual bookkeeping

👉 GOVT & TAX FILINGS

Annual management reports

Unaudited Financial Statements

Estimated Chargeable Income

Corporate Tax Return

Starter

€100/mo

€990/year

👉 DAILY SUPPORT

Personal Accountant & Bookkeeper

MBS software

Annual bookkeeping

👉 GOVT & TAX FILINGS

Annual management reports

Unaudited Financial Statements

Estimated Chargeable Income

Corporate Tax Return

👉 E-COMMERCE SOLUTIONS

Free integration with one sales platform: Lazada, Amazon, Shopify or others

Platform fees separated & converted into accounting data

Tax rates assigned for each item and each country of sales

Booming

€199/mo

€1990/year

👉 DAILY SUPPORT

Personal Accountant & Bookkeeper

MBS software

Annual bookkeeping

👉 GOVT & TAX FILINGS

Annual management reports

Unaudited Financial Statements

Estimated Chargeable Income

Corporate Tax Return

👉 E-COMMERCE SOLUTIONS

Free integration with one sales platform: Lazada, Amazon, Shopify or others

Platform fees separated & converted into accounting data

Tax rates assigned for each item and each country of sales

“I've moved not just one business to MBS, but a number. If you’re a small business it’s the place to be — you’ll save time and sleep.”

“MBS is a fantastic partner for the complex accounting needs of our venture-backed corporate structure. Extra credit for helping us with fundraising transactions!”

“I’m actually surprised they kept all their promises! I found MBS on Friday and on Monday morning everything was ready.”

We know how to do accounting and optimise tax for your business

Every industry has its own perks and complications when it comes to bookkeeping and accounting. We advise what tax exemptions and tax reliefs your company is entitled to, and we organise your reports exactly the way needed to comply.

Software Industry

The economic rise of Estonia relied heavily on hi-tech products. Over the last 10 years, the country has become a world-renowned technology hub. This atmosphere fosters great ideas.

Manufacture Industry

Estonia is the 4th largest global exporter of high tech products, with manufacturing contributing about 20% to the GDP. Key industry clusters include electronics, chemicals, biomedical sciences, logistics and transport engineering.

E-commerce Industry

EU e-commerce market revenue is expected to grow at 11.2% per year reaching 5.086 EUR billion by 2021. As locals practice social distance during the pandemic, more are turning to online shopping to avoid crowds.

Publishing Industry

Estonian are a nation of prolific readers. The city-state has one of the highest rates of literacy in the world.

Travel Industry

In 2017, 17.4 million international tourists visited Estonia. That’s three times more than the entire population of the city-state. All these travelers are craving high-quality services.

Hospitality Industry

Domestic tourism is giving a boost to the hospitality industry as locals look for a holiday. The Estonia government has also launched a EUR 45 million marketing push to help the tourism industry cope with the impact of the pandemic.

Financial Industry

Fintech sector is one of the fastest growing industries. Due to the high concentration of financial institutions, the Estonia market welcomes cryptocurrency, blockchain, and mobile banking projects.

Recruitment Industry

Estonia has a buoyant employment market. Companies turn to HR agencies to find suitable candidates both inside the country and overseas.

What you need to know about accounting in Estonia

-

What are the filing deadlines?

-

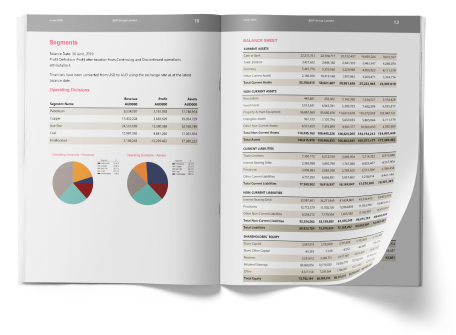

Can I see sample reports?

-

The taxes you have and don’t have to pay

- Financial Year End (FYE)

👌 You can choose any date, like March 31st

basic deadline for filing your reports - Estimated Chargeable Income (ECI)

👌 3 months after FYE

You file taxable income minus all tax-allowable expenses - C-S/C, the Annual Tax Returns

👌 November 30th year after the FYE

You report your taxes following these standards

Here are the most common reports we assist our clients with. Feel free to use them to get an idea of what is expected from your business. Do note that these are just samples, so make sure you check if there are any new regulations or specific requirements for your industry.

- Management Report

👉download sample

- Tax sample report

👉download sample

- Unaudited Financial Statements

👉download sample

We list the key tax rates below and explain exemptions in the tax guide:

- Corporate tax —Nil

- Tax on dividends — 18%

As Singapore has a one-tier tax system

- Tax on capital gains — Nil

- VAT — 21%

How to build B2B SaaS landing pages that actually convert

Well crafted landing pages pay dividends. They’re often made out to be an enigma but don’t need to be complicated.

5 steps to managing effective KPIs for your SaaS marketing team

How to create your first marketing dashboard

Need clarification?

What is T2D3?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Can I use T2D3 on my phone?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Can I change my plan later?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

What is so great about the Pro plan?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

.png?width=150&height=72&name=6065c517da816dbb8fc47195_KH_logo%20(1).png)